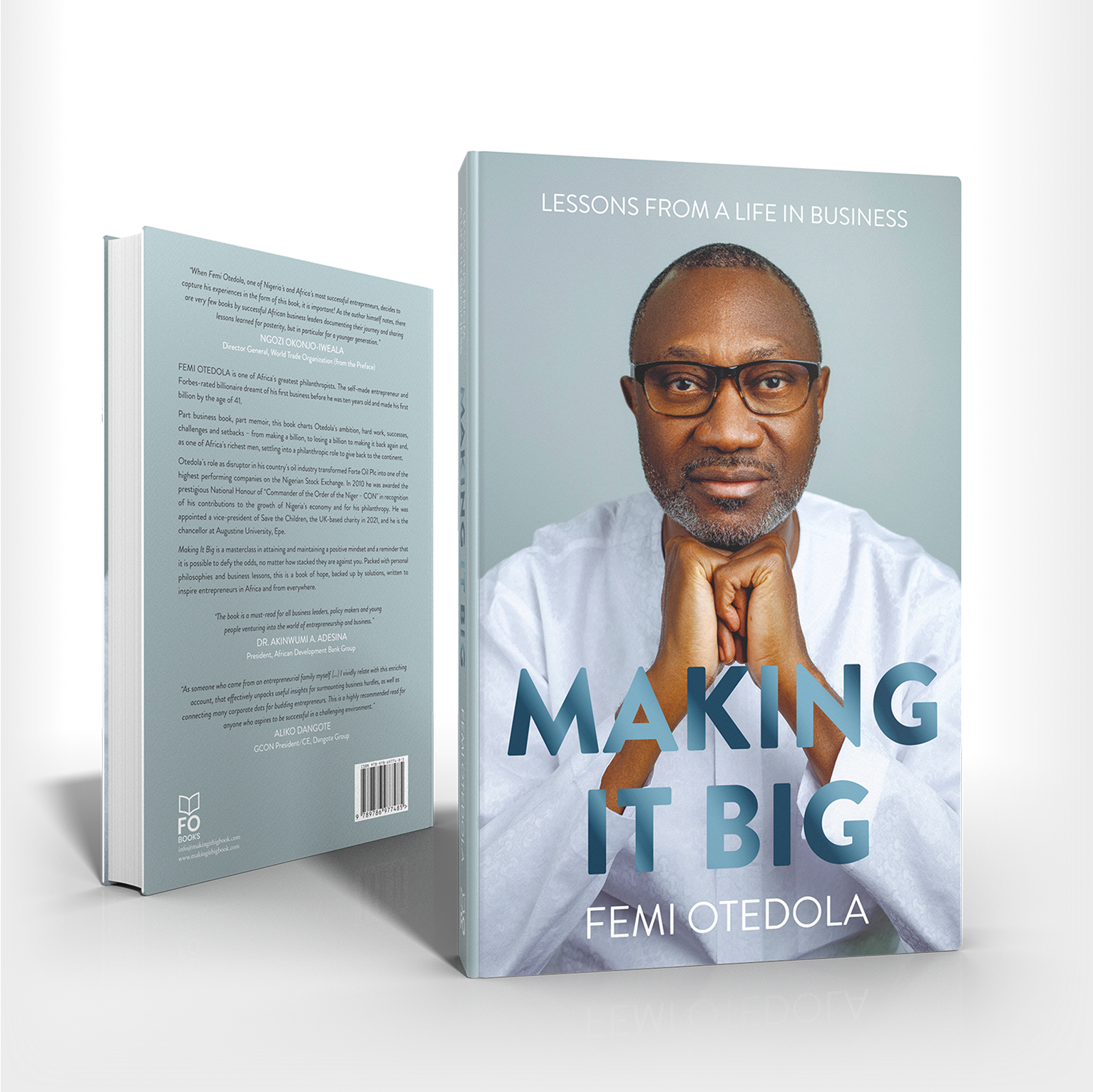

When I first heard that Femi Otedola had released a memoir, Making It Big, I was indifferent. Another billionaire telling us how he made it? My expectations were low. I assumed it would be one of those polished, PR-perfect success stories that skips the struggles and lands straight in the private jet.

But reviews began to flood my feed from people I respect deeply in media and business circles. Chude Jideonwo‘s take wasn’t just praise; it was an honest reflection. Chude doesn’t dish out compliments lightly, especially on stories that attempt to distil the complex reality of Nigerian business success. When I saw his review, I knew I had to get a copy.

So I gave in. I picked up Making It Big. And from the very first chapter, I couldn’t stop reading.

The memoir isn’t just a billionaire’s brag. It’s not a glossy, PR-friendly narrative. It’s raw, real and relatable. It is a story about reinvention, risk, and above all, the mistakes and learning curves that often go untold. It’s a deep dive into the personal and financial principles that built the Otedola brand, and the human costs that came with that journey.

In Nigeria, many high-profile entrepreneurs prefer to remain silent or cryptic about how they amassed their wealth. They let rumours fly and let the image do the talking. The public sees only the result: the mansions, the flashy cars, the headline-making deals. But rarely do they get a window into the messy process, the setbacks, the doubts, the recalibrations.

Otedola breaks that mould.

He pulls back the curtain to show us both the shine and the scars. He discusses collapse and rebirth, the weight of expectations, and the necessity of reinventing oneself. It made me realise that we need more honest, unfiltered, homegrown success stories like this. Stories that don’t just celebrate wealth but explore the lessons, the pain, and the growth behind it.

One of the most compelling themes in Making It Big is financial discipline. Otedola shares frankly: “Building a property portfolio came to me as naturally as breathing. Nobody prods you to start investing in property; it comes with the territory when you have extra income.” This struck me deeply. For many Nigerians, especially those climbing the economic ladder, investing can seem intimidating or even out of reach. Yet here is a man who sees property not as a luxury, but as a foundational tool for financial security and legacy.

He also shares a timeless lesson: “We are taught not to keep all our money in banks, but to spread across different sectors and portfolios.” Otedola advocates diversification and explains how he thought through risks, why he chose certain sectors, and how timing was everything. For example, borrowing dollars at ₦117 to $1 and repaying at ₦165 to $1 was a move that could have gone either way. These aren’t abstract ideas; these are strategies executed at billion-naira scales.

Otedola’s edge lies in reinvention and a strategic use of visibility. He writes, “For most of my adult life, I have believed in, and successfully executed, strategic reinventions… Evolution teaches us that you can adapt or die.” His ability to pivot from oil to energy, from traditional business to supporting his children in entertainment, exposes his remarkable flexibility that many business leaders lack. While many billionaires guard their stories closely, Otedola weaponises his, using media as a tool not just to control the narrative but to reflect openly on missteps and amplify his legacy.

This honesty extends beyond business into the personal. For young professionals in their twenties and thirties, Otedola’s advice is refreshingly practical and grounded. He tells of stopping wearing watches in 2016 because his mobile phone kept better time, a subtle but clear rejection of status symbols.

“My friends waved their hands when talking so you could see their status-symbol watches,” he recalls, but the lesson is clear: don’t confuse appearances for substance. Instead, focus on building knowledge before jumping into any enterprise. “Knowledge is the best starting point,” he insists.

For those in mid-career, especially entrepreneurs between 35 and 50, Otedola offers lessons on resilience. He highlights the importance of knowing when to pivot if an industry fails you, the value of investing in assets that hedge inflation like real estate and energy and the need to avoid sentimentality in business.

“Everything has a price if you are willing to pay,” he states bluntly. This kind of pragmatic approach is often missing from the romanticised narratives around entrepreneurship, where passion is emphasised but the hard realities of business decisions can be glossed over.

Parents and mentors will find wisdom in Otedola’s reflections. He openly shares how he encouraged his children to pursue their passions, regardless of conventional expectations. “I was not embarrassed when they chose entertainment; I was elated.” He understands the importance of emotional and marital stability, calling marriage “the centre beam that stabilises both partners.” It’s a reminder that success is not just about money but about creating a solid foundation of life support.

That said, Making It Big is not without its gaps. I wished the book had gone deeper into certain areas, the Geregu acquisition, for instance. We know it was a landmark deal, but what did the due diligence involve? What nearly went wrong?

The memoir touches on major business losses but sometimes skirts the emotional toll, mental health struggles, friendships lost, or the sting of public backlash. Given Otedola’s unique position as a former first son and major investor, his experiences navigating government relationships would also have added rich insight for entrepreneurs grappling with regulatory challenges. Yet perhaps this measured restraint is part of his wisdom to share what educates and inspires, without opening wounds unnecessarily.

Beyond money and business, Otedola doesn’t shy away from discussing the human side of success. He reminds us: “If you are under 40, you can get away with eating junk food… but as you approach your 50s… You need to take better care of your body.” This is a warning to anyone who thinks ambition can outpace health. Your body is your most important capital.

On dealing with people, he offers rare advice in the Nigerian business climate: “Forgive those who hurt you… People who are jealous of you will badmouth and attempt to destroy you. It is a mistake to live your life focused on these negatives.” The world is now defined by rivalry, rumour, and reputation battles; Otedola’s words remind us that forgiveness isn’t just kindness, it’s a form of freedom.

Making It Big is not just a book for entrepreneurs. It’s for anyone trying to grow something meaningful, understand money deeply, reinvent themselves, or build a legacy without losing their soul. It’s not a step-by-step manual; it’s a how-I-did-it story, and in many ways, that’s far more powerful.

If you are a Nigerian entrepreneur, don’t wait for billionaires to share their stories, the messy middles, the silent losses, the tough calls. Start writing your own. We don’t just need more billionaires. We need more builders who are willing to teach, document and inspire. That’s what Otedola did here. It’s our move now.

The post Kehinde Ajose: My Thoughts After Reading Femi Otedola’s Making It Big appeared first on BellaNaija - Showcasing Africa to the world. Read today!.

5 hours ago

2

5 hours ago

2